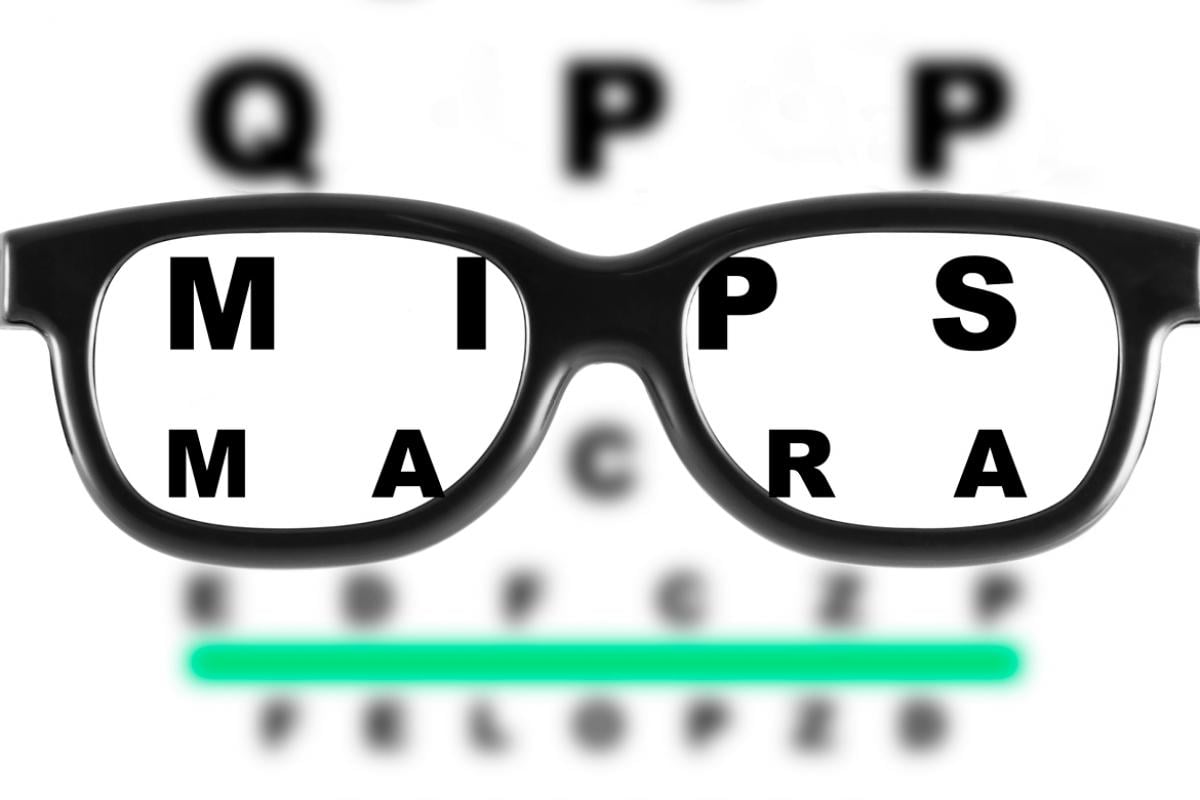

The Medicare payment system is being transformed as the Centers for Medicare and Medicaid Services (CMS) link payment updates to physicians’ efforts to improve quality of care, reduce health care spending and participate in alternative payment models. Use AMA’s tools and resources to better manage the impact of these changes to the physician fee schedule and Quality Payment Program (QPP).

Medicaid changes are creating additional pressure on practices that are already relying on Medicaid payments. Any changes to Medicaid financing should not undermine coverage gains that occurred under the ACA—particularly for individuals with the lowest incomes. Learn what the AMA is doing to ensure patients, particularly those with chronic conditions, don't lose their Medicaid coverage.