Although the medical liability environment for physicians is stabilizing, premiums vary greatly by geographic location and expenses to resolve liability claims are at some of the highest levels ever, according to two new AMA reports that examine medical professional liability insurance trends.

Although the medical liability environment for physicians is stabilizing, premiums vary greatly by geographic location and expenses to resolve liability claims are at some of the highest levels ever, according to two new AMA reports that examine medical professional liability insurance trends.

One report looks at medical liability insurance premiums, which largely have been stable for the past eight years. “Premium increases are much less common than they were a decade ago,” the report noted. Another report analyzed trends in expenses and indemnity payments (the amount paid to a claimant or plaintiff), the latter of which also have been mostly stable in recent years.

Some highlights from the reports:

- Premiums were largely stable. About two-thirds of premiums reported in 2014 did not change from the previous year. However, not every area has experienced such stability. Despite a drop in 2014, some reported premiums in certain areas of New York increased most years since 2005.

- Premiums vary widely by location. For example, in 2014, OB-GYNs faced manual premiums that ranged from a low of $49,804 in some areas of California to a high of $214,999 in Nassau and Suffolk counties in New York.

- Recently, expenses have leveled off. After a period of pronounced growth during 2005-2009, when average expenses in resolving claims grew by nearly 63 percent, average expenses were nearly $49,000.

- Historically, total expenses incurred on claims have been rising much faster than total indemnity payments. In 2013, total indemnity payments were three times higher than in 1985. In contrast, the increase in total expenses was seven-fold.

- Expenses vary by claim disposition. By far, the highest average expense in 2013 was for tried claims that resulted in plaintiff verdicts, with an average cost of $251,541. The next highest was for trials that resulted in defendant verdicts, at an average of $140,239.

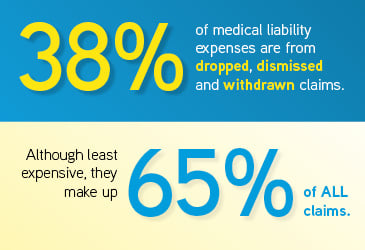

- Most claims continue to be dropped, dismissed or withdrawn. In addition to 65 percent of claims that were dropped, dismissed or withdrawn in 2013, another one-quarter of claims were settled, and 2 percent were decided by an alternative dispute resolution. A small amount—less than 8 percent—were decided by trial verdict, and the vast majority of these were won by the defendant.

Taking non-monetary factors into account, such as time spent defending claims, compromised reputation and other psychological costs physicians face, the total costs associated with liability insurance claims may be even higher than indicated.

While the overall liability climate has stabilized, the prospects for the short term remain unclear, the reports said. One reason for this ambiguity lies in the uncertainty among actuaries about how the medical liability market will be affected by the Affordable Care Act.

Find these analyses and others on the AMA policy research Web page.